Passive income: 7 ways to make multiple streams of income

The sum total of my financial education was this: get a good job, save 20% of your salary and don’t spend more than you earn. Which, to be fair, is all solid advice.

The issue I have with this? It makes me extremely reliant on my traditional 9-5. If there comes a time when I need to take a break from work, for any reason at all, it leaves my income in a vulnerable position and could seriously impact my long-term financial health.

This is the problem with active income, or income that trades your time and energy for money. While it may be a regular income stream, it can be limited by how many hours you physically can work or by salary caps. Your regular salary, freelance work and tutoring are all examples of active income.

What do I need to know about active vs. passive income?

While active income relies on an energy trade-off, passive income is, well, passive. Normally, we think of passivity as something negative – your friend who’s a bit of a walk-over, or a lazy boyfriend. But when it comes to your finances, getting passive could be the best thing you ever do.

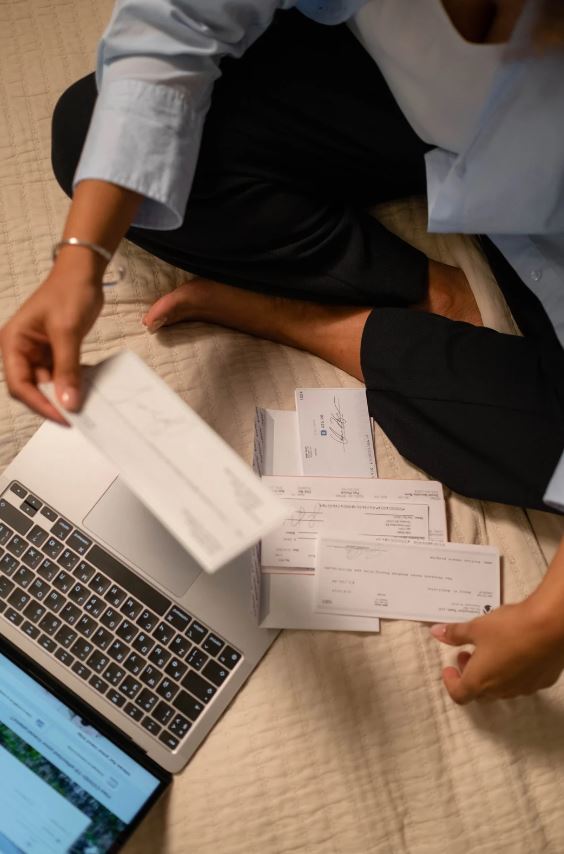

Passive income is the money you make without ongoing active involvement, so you maintain keep a healthy bank balance without spending your precious time and energy hustling for it.

Think of active and passive income like the difference between a marathon and a sprint. Active income requires a steady, if not constant, effort over a long period of time. Passive income requires a concerted burst of effort at the start, but it will continue to benefit you long after you’ve recovered your breath.

And the best part? Once you’ve got one set up, you can use the income from that to get the ball rolling on the next, until you have multiple, automatic streams of income.

How do I make passive income?

The four most common types of passive income are:

Dividends from stock investments

These are payments from companies based on the number of stocks you have. For example, let’s say you own 100 shares of Company A and they are valued at $1 per share. If Company A announces it will be paying out 5% in dividends, that means you will receive $5. The most common way to receive dividends these days is as a credit to your brokerage account. You can then cash this out or re-invest it.

Compound interest on stock investments

To understand how this works, click here for our ultimate guide on compound interest.

Royalties

Payments made when a consumer uses a product you have created. Some great examples of royalties are book royalties, patent royalties and franchise royalties (for example, if you wanted to open a franchise of Sephora, you would have to pay royalties to the Sephora company)

Rental income

Pretty self-explanatory, but you can earn rental income through anything from an AirBnB to a parking space.

Sounds like I need some passive income…but are there any risks?

There’s no reward without a little risk, and passive income is no different. While the main risk of active income is losing your job, the risks associated with passive income are a bit more varied.

With any form of passive income, you need to be prepared some market fluctuations. The value of your stocks or rental properties could go down during a period of recession, just as you’ll earn more from them in a period of inflation. If you are hoping to retire on royalties (I see you, Sarah J. Maas, and I support it) you need to be prepared for periods when your book, song or product may not sell as well as you like. Royalty income can be extremely inconsistent, and for the vast majority of us, it’s probably best not to rely entirely on an unknown sum of money dropping into your bank account at periodic intervals.

The other risk with passive income is that you may take it a little too literally. Ignoring maintenance requirements, such as that leak in your rental property or sorting out a bug on your website could end up costing you more than you would have earned. If you want your income to be completely effort-free, it’s better to sacrifice a little profit now and hire someone to maintain it for you, than to get stung with a huge bill when the ceiling caves in.

Finally, depending on where you’re from, you will need to check the tax requirements for passive income. Each country will have its own tax laws, and you don’t want to get hit with a huge tax bill that wipes out the income you’ve made.

I want to set up a passive income stream…but I don’t know where to start

As if we would exalt how amazing passive income and then just leave you to do it all yourself. We’ve got you covered with our top ways to make passive income.

- Invest in ETFs: this is probably the easiest option, requiring the least amount of work. For everything you need to know about getting started in ETFs, click here.

- Rental income: this requires a huge injection of cash upfront so it won’t be for everyone. But even if your property is mortgaged, the rent will probably cover the mortgage with some left over. You can even use this to get a down-payment together for your next property. Property can be risky, but it can also be extremely high reward.

- Affiliate sales: websites like Amazon offer commission to people who sell their products. And here’s a trick you might not have known, if someone clicks on to Amazon through your link and then purchases anything at all from Amazon, you pocket commission on that too.

- Stock photos: ever wonder where blogs get their photos from? I can assure you, I’m not out on a weekly basis taking themed pictures for each post. Instead, bloggers most often use websites like Canva and iStock to download stock images. Each time your picture is downloaded you will earn a small royalty. You don’t need to be a professional photographer – just someone with a good eye and a decent phone camera.

- Printables: in a similar vein, if you have a creative streak, you can design printables using websites like Canva and sell them on Etsy. You could design downloadable print art, which buyers can take to a print shop and have framed or you could make printable fitness trackers. Etsy take a portion of the profits for hosting your shop, but it’s still a great platform to reach a wide audience.

- Advertising: companies want to sell their products, and they have enormous advertising budgets to do so. There are lots of ways you can make money from advertising, such as having your car wrapped to advertise a specific brand, incorporating advertising into your social media posts or starting a blog on a topic you love and building up to a point where you can advertise.

- Cashback apps: this one isn’t really a huge source of passive income, but it can be a nice little top-up for treats that don’t cost you a penny. Using a cashback app, you make money back when you purchase through companies affiliated with the app. This sounds like spending pounds to make pennies, but when the pounds you are spending are on necessities like groceries, why wouldn’t you try to earn back a little cash? If you are based in the US, BeFrugal is a fantastic option and for UK readers, TopCashback is an app that I personally used and loved when I lived there.

It may take time to build up a source of passive income to the point where you start seeing a return on your time, effort and money. The more streams of passive income you have, the less vulnerable you will be, leaving you free to enjoy the reward for your risk.

Do you have a passive income, or are you working on it? Let us know in the comments below or tag us on Instagram @fearlessgirlfinance_

Add A Comment